The Consumer Confidence Survey® reflects prevailing business conditions and likely developments for the months ahead. This monthly report details consumer attitudes, buying intentions, vacation plans, and consumer expectations for inflation, stock prices, and interest rates. Data are available by age, income, 9 regions, and top 8 states.

US Consumer Confidence Inched Up in February

Latest Press Release

Updated: Tuesday, February 24, 2026

Confidence edged higher but remained well below heights reached in late 2024

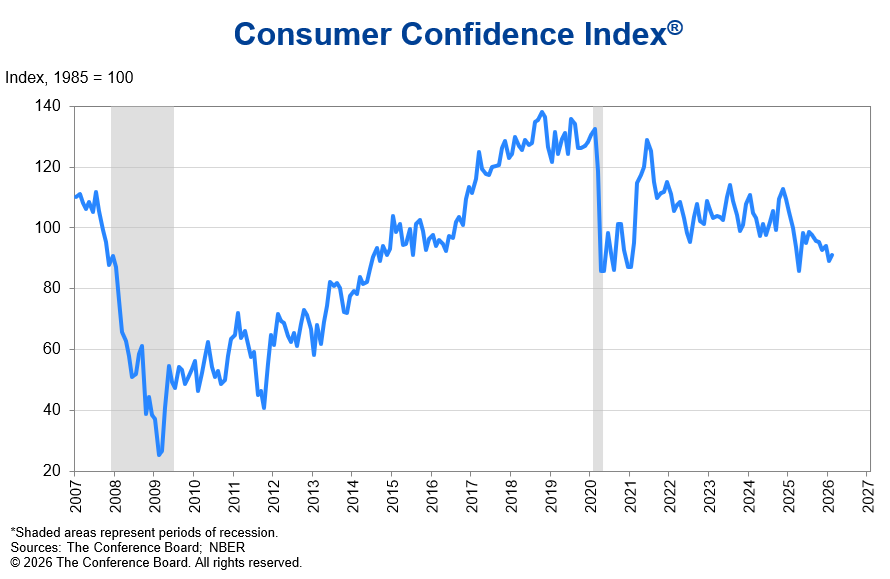

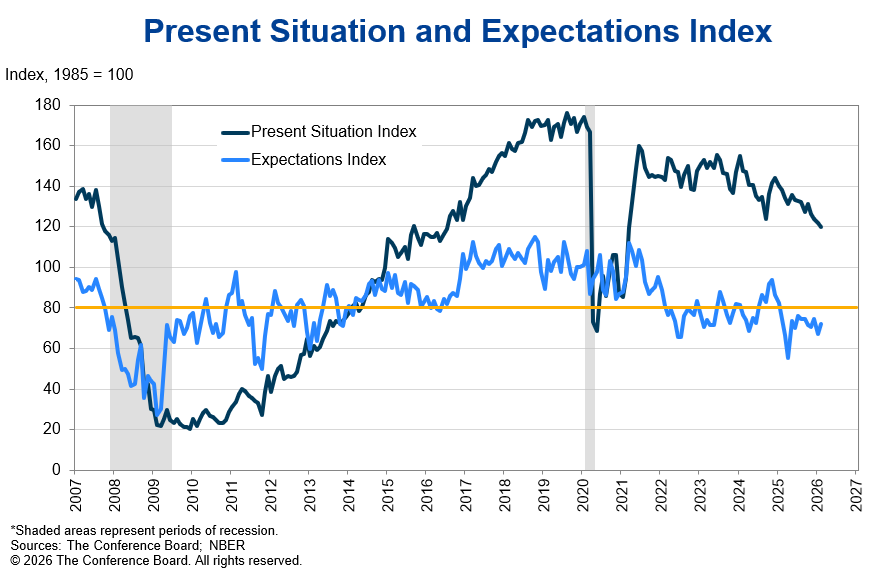

The Conference Board Consumer Confidence Index® increased by 2.2 points in February to 91.2 (1985=100), from an upwardly revised 89.0 in January. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—decreased by 1.8 points to 120.0 in February. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—rose by 4.8 points to 72.0. The cutoff for preliminary results was February 17, 2026.

“Confidence ticked up in February after falling in January, as consumers’ pessimistic expectations for the future eased somewhat,” said Dana M Peterson, Chief Economist, The Conference Board. “Four of five components of the Index firmed. Nonetheless, the measure remained well below the four-year peak achieved in November 2024 (112.8).”

The Present Situation Index continued to decline, as net views on current business conditions fell to +0.7%. Perceptions of employment conditions improved slightly, with the labor market differential—the share of consumers saying jobs are “plentiful” minus the share saying jobs are “hard to get”—rising 0.6 ppts to +7.4%. All three Expectations Index components advanced slightly in February: expectations for business and labor market conditions six months from now were less negative, while expectations for incomes were more positive.

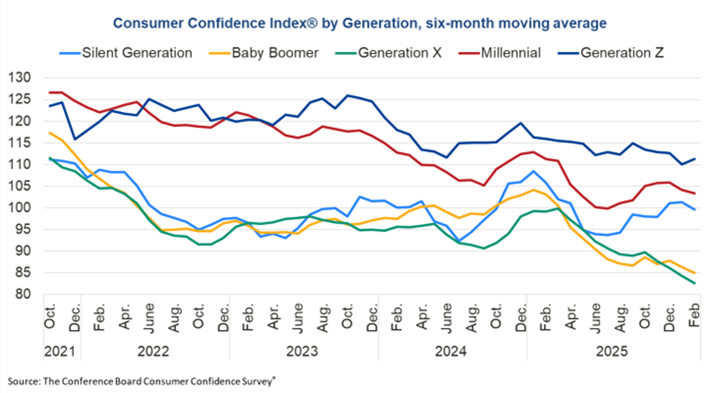

Among demographic groups, confidence on a six-month moving average basis ticked upward in February for consumers under age 35, which continued to be the most optimistic group. Confidence edged down for respondents 35 and older. Relatedly, on a six-month moving average basis, confidence among Generation Z rose, consistent with soundings from the under-age 35 group, but fell among other generations. By income, confidence on a six-month moving average basis continued to dip for most brackets. Consumer confidence by political affiliation revived among Republican and Independent voters in February after a dip in January, while Democrats were less optimistic.

Peterson added: “Consumers’ write-in responses on factors affecting the economy continued to skew towards pessimism. Comments about prices, inflation, and the cost of goods remained at the top of consumer’s minds. Mentions of trade and politics also increased in February. Labor market mentions eased a bit in February, while observations about immigration increased somewhat.”

Consumers’ average and median 12-month inflation expectations were little changed but remained elevated. Consumers also believed that interest rates will persist at higher levels over the next 12 months. Most consumers in February continued to expect stock prices to be higher twelve months from now, although the share was slightly smaller than last month.

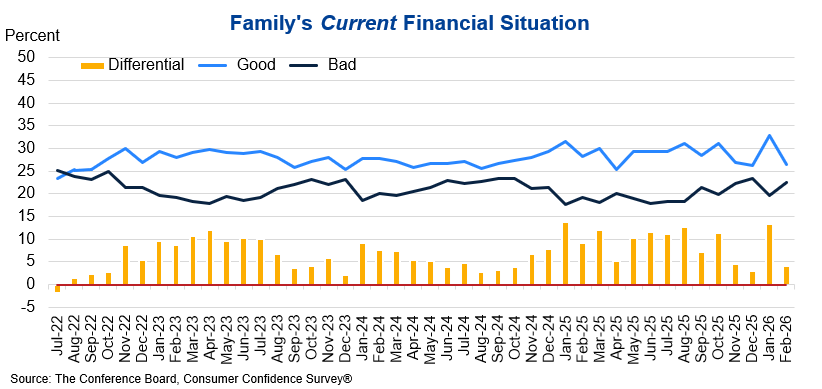

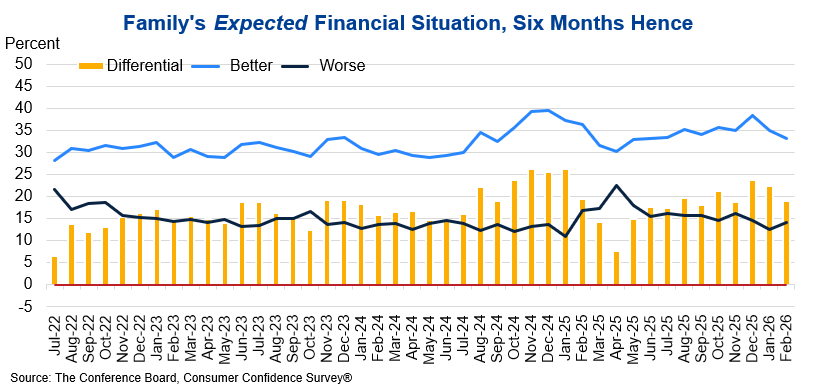

On net, consumers’ views of their Family’s Current Financial Situation retreated in February, after an unexpected surge in January, based on final data. Expectations for their Family’s Future Financial Situation continued to be less optimistic. Meanwhile, the share of consumers who said a US recession over the next 12 months is “very likely” fell, while those saying “not likely” rose. Respondents who said recession is “somewhat likely” over the next year increased somewhat, and the percent believing we are “already in one” dipped. (These measures are not included in calculating the Consumer Confidence Index®).

Consumers’ plans to buy big-ticket items over the next six months rose in February. Those who said “yes” and “maybe” to buying big-ticket items ahead increased, while the number of those saying “no” declined. Used cars, furniture, TVs, and smartphones remained the most popular items within their categories for future purchases.

Buying plans for autos rose on a six-month moving average basis, continuing its uptrend in recent months. Consumers continued to prefer buying used cars. The share of consumers planning to buy a new car was unchanged. Homebuying expectations were little changed in February but continued to retreat on a six-month basis. Still, the share was above levels one year ago.

Plans to purchase furniture, TVs, dishwashers, and ranges on a six-month moving average basis ticked up, while buying plans for refrigerators and washing machines edged down. Plans to buy electronics were little changed in February, except for smartphones, which continued to trend upward on a six-month moving average basis.

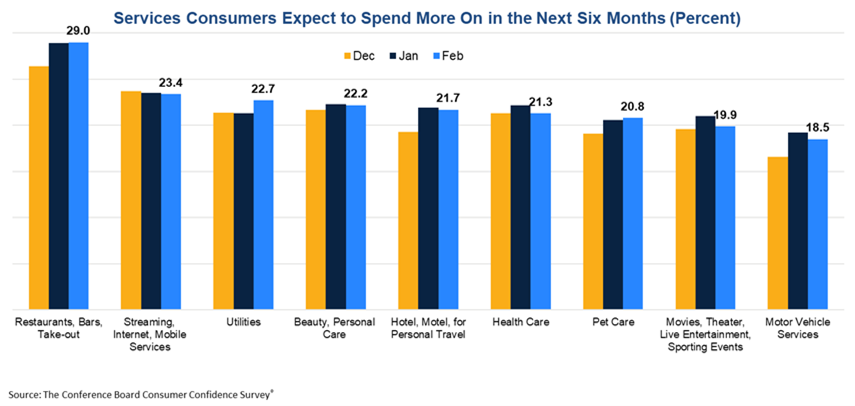

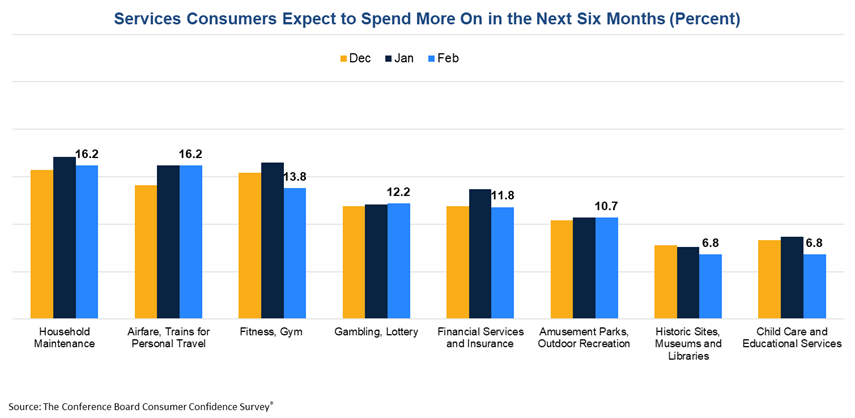

Consumers’ planned spending on services over the next six months softened somewhat in February but remained healthy. The share who said “yes” fell, while those who said “maybe” and “no” increased. Consumer spending trends in 2026 remain focused on cheap thrills and necessary services, and away from expensive and highly discretionary activities.

Among services categories, anticipated spending over the next six months on utilities, pet care, and gambling/lotto services increased, but most other categories dipped or were unchanged. Restaurants, bars, and take-out remained the top category for expected spending ahead and edged 0.1% higher in February. While streaming, internet, mobile services; beauty and personal care; and hotel/motel for personal travel remained among the top five categories, intentions for each of them eased. Overall vacation plans over the next six months dipped in February, with small declines in both domestic and international travel. Expected spending on airfare, trains for personal travel was unchanged.

Present Situation

Consumers’ views of current business conditions deteriorated on net in February.

- 19.7% of consumers said business conditions were “good,” a small uptick from 19.6% in January.

- 19.0% said business conditions were “bad,” up from 17.3%.

On net, consumers’ views of the labor market improved slightly in February.

- 28.0% of consumers said jobs were “plentiful,” up from 25.8% in January.

- 20.6% of consumers said jobs were “hard to get,” up from 19.0%.

Expectations Six Months Hence

Consumers were less pessimistic about future business conditions in February.

- 17.6% of consumers expected business conditions to improve, up from 16.5% in January.

- 21.0% expected business conditions to worsen, down from 23.7%.

Consumers were also less negative about the labor market outlook in February.

- 15.7% of consumers expected more jobs to be available, up from 14.8% in January.

- 26.1% anticipated fewer jobs, down from 28.7%.

Consumers’ outlook for their income prospects was slightly more optimistic in February.

- 17.3% of consumers expected their incomes to increase, up slightly from 17.2% in January.

- 12.3% expected their incomes to decline, down from 12.7%.

The monthly Consumer Confidence Survey®, based on an online sample, is conducted for The Conference Board by Toluna, a technology company that delivers real-time consumer insights and market research through its innovative technology, expertise, and panel of over 36 million consumers. The cutoff date for the preliminary results was February 17.

Source: February 2026 Consumer Confidence Survey®

The Conference Board

The Conference Board publishes the Consumer Confidence Index® at 10 a.m. ET on the last Tuesday of every month. Subscription information and the technical notes to this series are available on The Conference Board website: https://www.conference-board.org/data/consumerdata.cfm.

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. TCB.org

The next release is Tuesday, March 31 at 10 AM ET.

© The Conference Board 2026. All data contained in this table are protected by United States and international copyright laws. The data displayed are provided for informational purposes only and may only be accessed, reviewed, and/or used in accordance with, and the permission of, The Conference Board consistent with a subscriber or license agreement and the Terms of Use displayed on our website at www.conference-board.org. The data and analysis contained herein may not be used, redistributed, published, or posted by any means without express written permission from The Conference Board.

COPYRIGHT TERMS OF USE All material on Our Sites are protected by United States and international copyright laws. You must abide by all copyright notices and restrictions contained in Our Sites. You may not reproduce, distribute (in any form including over any local area or other network or service), display, perform, create derivative works of, sell, license, extract for use in a database, or otherwise use any materials (including computer programs and other code) on Our Sites ("Site Material"), except that you may download Site Material in the form of one machine readable copy that you will use only for personal, noncommercial purposes, and only if you do not alter Site Material or remove any trademark, copyright or other notice displayed on the Site Material. If you are a subscriber to any of the services offered on Our Sites, you may be permitted to use Site Material, according to the terms of your subscription agreement.

Trademarks "THE CONFERENCE BOARD," the TORCH LOGO, "CONSUMER CONFIDENCE SURVEY", "CONSUMER CONFIDENCE INDEX", and other logos, indicia and trademarks featured on Our Sites are trademarks owned by The Conference Board, Inc. in the United States and other countries ("Our Trademarks").

You may not use Our Trademarks in connection with any product or service that does not belong to us nor in any manner that is likely to cause confusion among users about whether The Conference Board is the source, sponsor, or endorser of the product or service, nor in any manner that disparages or discredits us.